Welcome!

Lets get you protected

Interested in life insurance or mortgage protection? Skip right to the contact form and I will reach out via a 15-20 minute call!

Morgan Vande Brake

FFL Prosper Insurance Agent

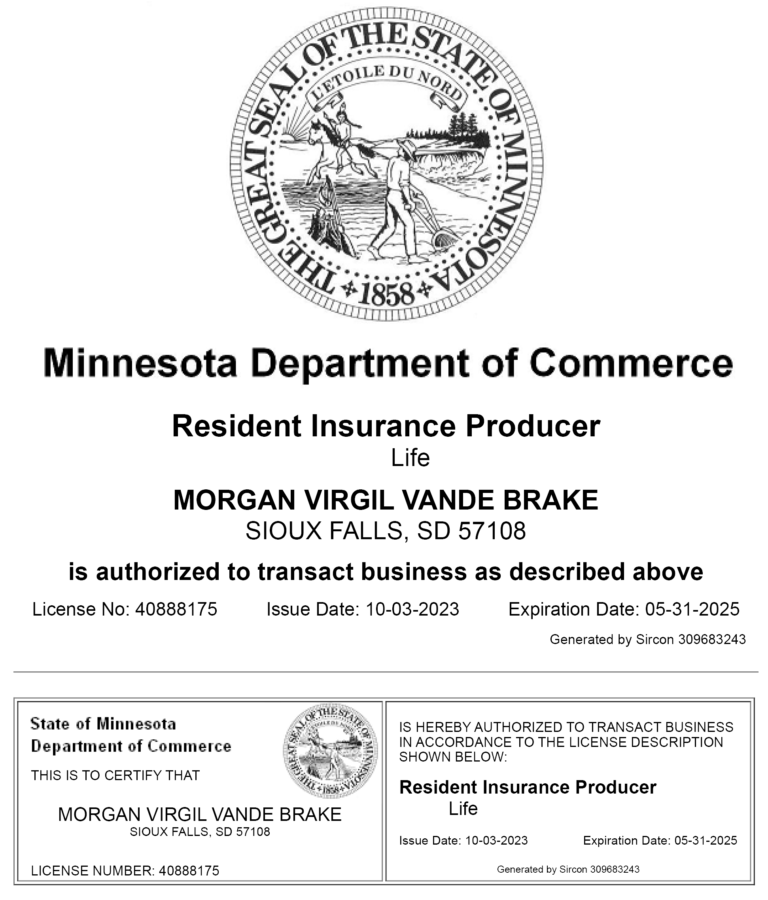

Howdy, my name is Morgan. State license life insurance agent looking to help any families interested in getting some coverage to secure the future of loved ones and estates. I am really passionate in helping people in all ways hence, the health and wellness page. Life insurance is just another way I can change peoples lives. The difference a policy can make on family in the event of loss etc. is immense. The stories clients and fellow agents alike have shared about personal stories is the driving force in why I am pursuing this position. Reach out and let’s chat about what you are in need of and lets knock it out! You can find FAQ as well as an attached copy of my state license at the bottom of this page.,

Grab my info and reach out or fill out the form to request a phone meeting!

- 52042 750th St Jackson, MN

- +1 605 880 2477

- Morganvandebrake.ffl@gmail.com

- Mon-Saturday 8:00 am - 7:00 pm

Schedule a Call!

As soon as I get this info I will give you a call and we can see about getting you the coverage you need!

Resident State License.

Current non-resident state licenses: Iowa

Frequently Asked Questions

There are three main things that will break down possible coverage. Those three things include: medical history/age, financial position, and finally your specific needs.

Mortgage protection and or equity protection are versions of life insurance set into place to avoid leaving the weight of your mortgage on loved ones if anything happens to you. Equity protection protects the value you’ve built into the home and stops the bank from taking the equity and auctioning your home.

There are many things that each a term and whole life policy may include that distinguish them. Mainly being the expiration date. Whole stays indefinitely or until age 120. Term policies stay enforced for a period of time. Term can be cheaper for larger face values.

I am a contracted with all of the top 36 carriers in the state and have never had a client I was not able to get a policy approved and in place!

An annuity is sort of a supplement to your roth ira or 401k but often with no loss in the market drops. Very useful for people looking to lump sum money into an account and let it accumulate for a set of years allowing it to make monthly pensions once it begins it’s payout period. These are sold by life insurance companies often but are not life insurance.

As many as you would like. There is really no limit. The limit is the amount of total coverage you can have between all companies.